Why traditional budgeting is the antithesis of Agile – and what to do about it

Most organizations are born small and born agile. They are nimble, trusting, collaborative, non-bureaucratic, and purpose-driven. But few want to remain small. Most want to grow and become big. Those who make it often have something in common. They discover that they have not only become big. They have also become slow, rigid, bureaucratic, detached, and often quite sad places to work. Engagement has plummeted, turnover increased, and customers are groaning.

There are some striking similarities with the aging process of humans. As we grow older, we lose much of the agility we had as teenagers. Mostly physically, but something tends to happen upstairs as well. This development in our body and mind is unavoidable. We can live healthily, but in the end, age takes us all. We have no choice.

Organizations, however, do have a choice. There is no natural law stating that big must mean slow and sad. An increasing number of executive teams are therefore asking themselves a big and crucial question. “How can we find our way back to what we had when we were small, without losing the benefit of being big?”.

Likewise, small organizations wanting to grow should ask themselves: “How can we grow without ending up in the same misery?”.

When Agile was born, it was not about making big organizations ask big questions and help them reinvent themselves as the startups they used to be. Although Agile was rebelling against many aspects of traditional management, the focus was on how it negatively impacted software development and how teams could work better, and not on how the entire organization should be run in an agile way.

Agile challenged corporate demands about waterfall planning, business case documentation, utilization and economy of scale, almighty managers managing siloed work, and many other traditional management beliefs. A vibrant Agile community and great new ways of working emerged, all inspired by the Agile Manifesto.

And here we are, many years later. The results are simply amazing. Agile has revolutionized software development and has become the new standard. It is non-controversial. Nobody is discussing going back, it is all about making it work even better.

But all isn’t rosy. There is still friction. The fact that IT and later other functions embraced Agile did not solve the many fundamental conflicts between traditional corporate processes and the agile philosophy. “Scaling Agile”, which later developed into various “Business Agility” frameworks, was therefore a natural response, based on the belief that the entire organization needs to operate on Agile principles.

It was an obvious next step, but it came with a few caveats.

First, it is hard to scale Agile using the same framework and the same language that worked so well for transforming software development. “Scrum” might sound like a skin disease for executives unfamiliar with rugby. A “Sprint” is not about running faster. “Slack” is not about laziness. “Continuous delivery” is not about efficient assembly lines.

We need a translation, something that helps executive teams better understand what Agile means at a corporate level. What does Business Agility really mean in practice?

But there is an elephant in the room, a problem that Agile has been suffering from since its early days. Although there have been complaints, little has happened. Maybe because it was seen as something given; a law of business, unavoidable and untouchable.

This is all wrong.

There is no such law. And if this problem isn’t challenged and solved, any Agile transformation will struggle.

But there is good news.

It is not only possible. It has already been solved in many organizations across the world, with amazing results.

We are talking about the budget, probably the most fundamental barrier there is to an agile transformation. Not just the annual budget and the budgeting process itself, but just as much the mindset behind it. Both are in so many ways the antithesis of Agile. Budgeting is built on two fundamental assumptions: the future is predictable, and people can’t be trusted. It doesn’t get more un-Agile.

These are the harsh and sad realities of a budget regime: the bank is only open once a year. Next year is spelled out with accounting precision. Any deviation is treated as something negative that must be explained. Employees are micromanaged on travel cost and stationery. It is a biased and political exercise which stimulates unethical behaviors and hurts decision-making. Performance is reduced to hitting the budget numbers. Purpose, values and collaboration become a joke because all eyes are on those numbers. And it consumes an awful amount of time.

The Agile principle of “continuous delivery” of software functionality is a classic example of philosophy crash. Budgets are made once a year, with an “annual delivery” of decisions and resources, and not continuously as needs appear and things change.

Budgeting is an old management technology. Almost 100 years ago, the inventor James O. McKinsey published his book “Budgetary Control”. His intentions were good: to help organizations perform better. It worked back then, because the setting was so completely different from today. Maybe it even worked 50 years ago. Today, however, with very different people- and business realities, this way of thinking and this way of managing is having the opposite effect. It has become an effective barrier for getting the best possible performance from our organizations.

The Beyond Budgeting movement emerged in the late nineties as a reaction to the serious damage this management concept has caused over the last decades. Maybe it was no coincidence that Beyond Budgeting and Agile was born roughly at the same time, and that the 12 Beyond Budgeting principles have so much in common with the Agile Manifesto, even if there was no contact between the two communities back then. That has fortunately changed, which this article hopefully illustrates.

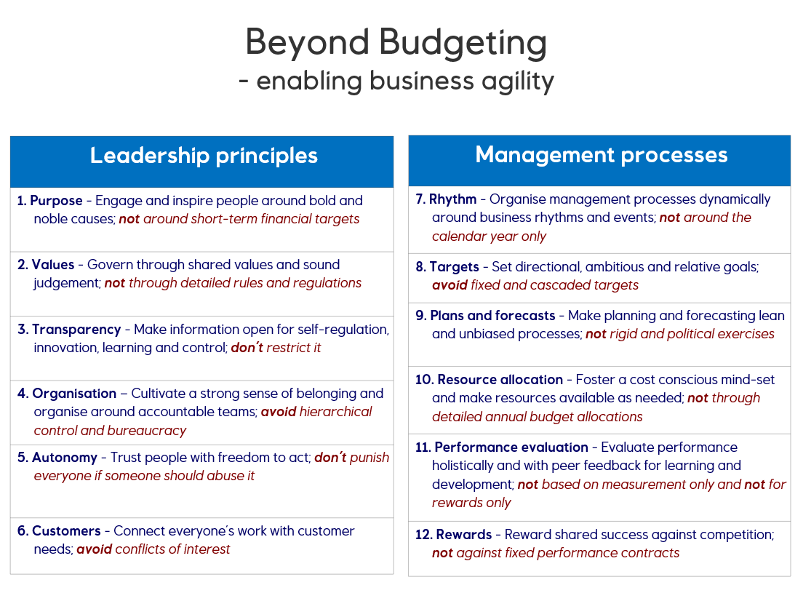

As the 12 principles below show, “budgeting” is not used in its narrow sense of planning and control, but as a more generic term for the traditional command and control management model (with the annual budget process at its core). In this context it describes both a leadership culture and a performance management system. It is about business agility in practice.

While there are many similarities with the Agile Manifesto, there is also a major difference. As discussed, due to its birthplace in software development and its focus on how teams work, a range of corporate management issues were simply out of scope for early Agile, such as the annual budget. Beyond Budgeting, on the contrary, was born as a challenge to traditional corporate management, and therefore addresses the many issues early Agile didn’t need to.

While there are many similarities with the Agile Manifesto, there is also a major difference. As discussed, due to its birthplace in software development and its focus on how teams work, a range of corporate management issues were simply out of scope for early Agile, such as the annual budget. Beyond Budgeting, on the contrary, was born as a challenge to traditional corporate management, and therefore addresses the many issues early Agile didn’t need to.

Beyond Budgeting was about Business Agility long before the term appeared. It is often the missing link in an agile transformation, and if left unaddressed, transformation success is highly unlikely.

Not only does Beyond Budgeting provide a business agility vocabulary which executives understand (even if some may disagree). The model also provides tangible and tested alternatives to traditional budgeting, as well as coherence with other management processes like Performance Evaluation and Rewards.

The six Management Process principles are, however, not only about improving management processes. They are just as much about activating important messages in the six Leadership principles, like Purpose, Autonomy, Values and Transparency. Process drives culture and behaviors, both positively and negatively.

These leadership messages are, however, not unique at all for Beyond Budgeting. Many other movements and models, including Agile, promote similar beliefs.

It doesn’t help, however, to have Theory Y leadership visions if there are Theory X management processes. The result is poisonous gaps between what we preach and what we practice, sadly seen in too many organizations. Douglas McGregor’s “The Human side of Enterprise” is just as relevant today as when it was published back in 1960. A key message in Beyond Budgeting is therefore about the need for coherence between leadership principles and management processes.

The tension between the two is often driven by a hostile HR and Finance relationship. These functions are not always the best of friends, and they often talk more about each other than with each other. I know from personal experience, as I have worked both places. Theory Y messages from HR are easily killed by the opposite messages coming from Finance, with budget control as a classic example.

This problematic relationship can however be turned into a great opportunity. Just like the two functions can block an Agile transformation, they can also unlock it. Finance and HR are responsible for the two most loathed corporate processes: budgeting and performance appraisals. Just as traditional budgeting is the antithesis of Agile, the same can be said about many appraisal processes and connected reward systems.

They both affect the entire organization, directly or indirectly. Making radical changes here will therefore send an extremely powerful message to everyone that the transformation is for real. Just as leaving them untouched carries the opposite message of no real change at all. If Finance and HR also join forces in supporting the transformation, it sends an even stronger message, as seen in some of the most successful Beyond Budgeting implementations.

Embracing all six Beyond Budgeting management process recommendations is therefore highly recommended, although we now will focus on the first four more budgeting-related principles of Rhythm, Target setting, Plans and Forecasts and Resource allocation.

The Agile community has as discussed long seen traditional resource allocation as the main problem. Many have recommended a more continuous VC type of funding process as the solution, or more frequent budget updates. This alone leaves however many other problems unsolved.

If we ask ourselves why we make budgets, there are typically three different reasons coming up. While the budget has a resource allocation purpose, handing out bags of money for expenditures and investments, it is also used to set targets – financial, sales or production targets. Finally, the budget shall help forecast and understand what lies ahead in terms of for instance cash flow and financial capacity.

Handling all these three purposes in one process and one set of numbers might seem very efficient. But herein lies also the problem. Imagine the start of a budget process, where Finance wants to understand next year’s cash flow. Starting with revenues, managers are asked for their best number. But everybody knows that what is sent upstairs tends to come back as a target, and often with a bonus attached. We all know what this insight can do to submitted numbers.

Moving to expenditures and investments, everybody knows this is the only chance to secure resources for next year, and many might also remember last year’s 20% cut. Again, we shouldn’t be surprised if this insight and this memory also influences what is proposed.

We all recognize the game, and we might smile and shrug it off as “that’s just the way it is”. But this is not funny, it is actually a serious problem. Not just because it destroys the quality of the numbers, but even more because this game stimulates behaviors which are at least borderline unethical. Lowballing, sandbagging and resource hoarding is not very compatible with the spirit of Agile.

Fortunately, there is a simple, effective and tested solution. The three purposes should be separated into three different processes, because they are about different things. A target is an aspiration, what we want to happen. A forecast is an expectation, what we think will happen, whether we like what we see or not. And resource allocation is about optimization of scarce resources.

By separating, we allow for different numbers depending on purpose. A target should for instance be more ambitious than a forecast. But even more importantly, the separation enables significant improvements of each process. We can now make our targets much more inspiring and robust, we can take the politics out of our forecasts, and we can make our resource allocation much more effective. And finally, we can let each one run on a rhythm much better suited to the natural rhythm of each purpose, given the business we are in.

In the many organizations that have started their Beyond Budgeting journey like this, purpose separation often became a catalyst for even bigger discussions. Target setting; what really motivates the knowledge worker? And can we maybe do with less of them? Forecasting; what really causes the bias and the politics? Resource allocation; do we need detailed travel budgets if we say that we trust people? The separation is a safe and organic backdoor into a broader Beyond Budgeting discussion.

Many organizations across the world is today on a Beyond Budgeting journey. One of the pioneers is a Swedish bank; Handelsbanken, with more than 800 branches in northern and central Europe. Since 1970, the bank has operated without any budgets, targets, or individual bonuses, and with amazing results. The bank has performed better than the average of its competitors every year since 1972. It is among the most cost-effective universal banks in Europe, and the bank has never needed any bailout because they messed it up. Such a great performance over such a long period, with such a radically different management model. It can’t be a coincidence. Harvard Business School is one of many recognizing the power of the Handelsbanken model, including their quite unique view on bonuses.

Let us close with some advice if you are considering a Beyond Budgeting journey, either as part of an Agile transformation, or as a more stand-alone Finance process improvement initiative.

As discussed, few, if any are happy with the budgeting process, often including Finance. All the problems people complain about: time spent, assumptions quickly outdated, the politics and the gaming, the illusions of control, how decisions are made way too early and the rigidity that follows; these are more than irritating itches. These are symptoms of a deeper and more systemic performance barrier problem. Spend enough time on helping your organization understand this. The more people realize the underlying systemic nature of these problems, the stronger the case for change, and the easier the implementation.

Still, be careful with too much criticism of what many managers might have built their career on. Help them instead understand that things have changed.

Many organizations going Beyond Budgeting improve their forecasting process by implementing Rolling Forecasting. Here, forecasts are typically updated every quarter, always looking for instance five quarters ahead. This has many benefits and might be felt as an easy place to start.

But what about the two other budget purposes; target setting and resource allocation? How will these now be solved? If the answer is through Rolling Forecasting, the result is nothing but Rolling Budgeting. More work and very few problems solved. If the answer is to maintain a budget process for these two purposes, then most problems are again left unsolved.

The separation can therefore never be sequential, it must be done in parallel. At the same time as Rolling Forecasting (or the alternative Dynamic Forecasting) is introduced, new target-setting and resource allocation processes must also be introduced. Implementing Rolling Forecasting only is a classic implementation mistake.

Some will say that it is impossible to operate without a budget. Fair enough, but don’t forget that the separation means that we still do what the budget tried to do for us, but in much better ways because we can tailor each one to its main purpose.

The biggest implementation barrier will always be fear. Fear of losing control, costs increasing, or even chaos and anarchy. Although 25 years of implementation experience paints a very different picture, this nagging concern is certainly understandable. But if it should go wrong, how big is really the downside risk? It is in fact close to zero. If it doesn’t work, you can go back to the old way almost overnight. Nobody will have forgotten how to budget.

Compare this with the huge upside potential, as proven in so many implementation cases. The risk picture is not scary, it is compelling.

There is more advice to be found in my book Implementing Beyond Budgeting, where I write about my own implementation experiences in Borealis and Equinor (formerly Statoil), and also learnings from the many other organizations I have helped over the years.

Finally, check out the Beyond Budgeting Roundtable and learn about and from the many organizations that already have embarked on the journey. Your competitors might be among them.

Today, we all smile about the days before the internet. It feels like ages ago, but it isn’t. In the very foreseeable future, we will all smile just as much about what was mainstream management back in the 2020s. Does your organization want to be a vanguard, an early mover getting a sustainable competitive advantage, or being dragged in as one of the laggards?

The choice is yours, and it should be simple.

- I have throughout this article used the transformation word, although I struggle with it. “Transformation” indicates a project with an end date. But this is not a project. It is a journey, where the direction is clearer than the destination, if there is one.